Have you ever wondered where the money comes from to build roads, schools, and hospitals? What about how the government decides where to spend money and collect taxes? Understanding the public finance helps explain these mysteries.

Learning about public finance isn’t just for policy wonks. As a citizen, taxpayer, and participant in the economy, you should understand how public funds are collected and spent. Knowledge of public finance helps you evaluate leader’s decisions and make informed choices at the voting booth. In this article, we will cover the definition of public finance, its importance for society and insights of governments budgeting.

What Is Public Finance?

Public finance refers to the management of funds used to provide public goods and services. It involves the revenue, expenditure and debt operations of the government. In simple words, public finance deals with the financial management of the government and its various agencies.

Public goods are those goods which are non-excludable and non-rivalrous in consumption. Non-excludability means that no one can be excluded from using the good. Non-rivalrous means that consumption by one individual does not reduce the amount available for others. Examples of public goods are national defense, public parks, street lighting, etc. The government has to finance the provision of such public goods through public finance.

Also Read: The Fundamentals of Corporate Finance 2024.

Key Concepts in Public Finance

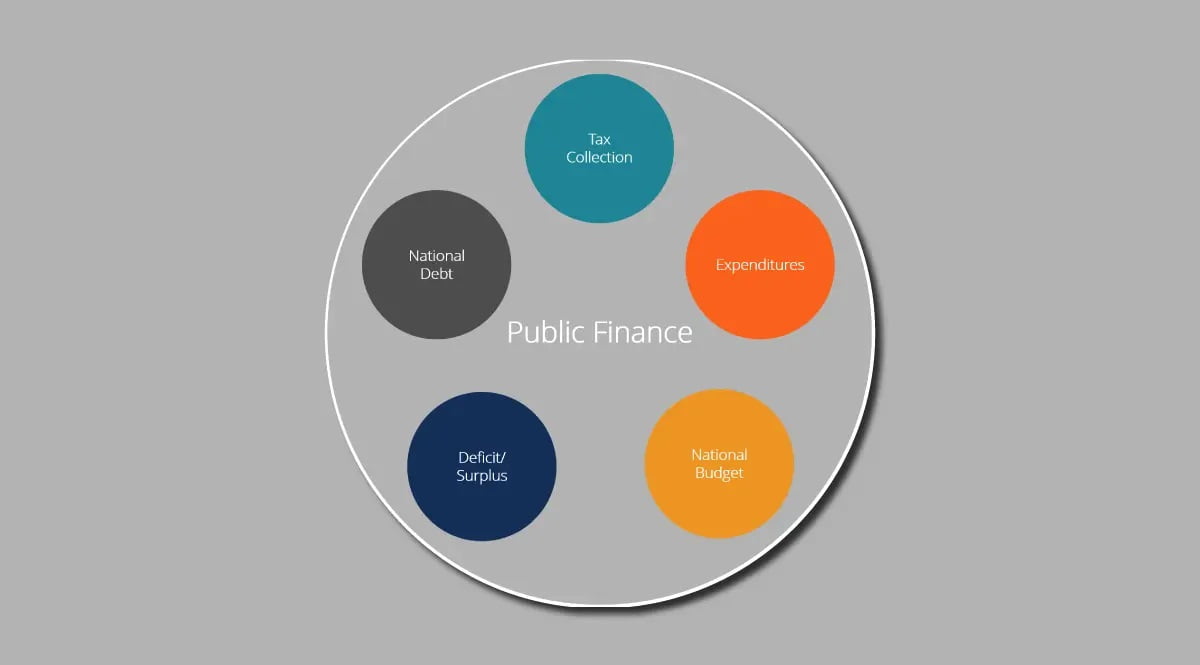

The key concepts in public finance are:

Revenue

Public finance fundamentally deals with the revenue and expenditure of the government. The revenue refers to the income generated by the government through taxes, fees, fines, and borrowings. The government mainly relies on tax collection as a source of revenue. Taxes like income tax, sales tax, property tax, etc. are imposed on individuals and corporations.

The government also generates non-tax revenue from sources like fees, fines, special assessments, sale of goods and services, and interest receipts. Revenue is crucial for the government as it funds important expenditures like infrastructure, education, healthcare, pensions, and national security.

Also Read: How to Take Control of Your Personal Finance 2024.

Expenditure

The expenditure refers to the spending of the government on goods and services. The government incurs expenditure on administration, defense, education, healthcare, infrastructure, interest payments, pensions, subsidies, and welfare programs.

The expenditure is classified into revenue expenditure and capital expenditure. Revenue expenditure is incurred on day-to-day administration and maintenance. Capital expenditure is incurred on the creation of assets like roads, buildings, machinery, and equipment.

Budget

The budget represents the government’s revenue and expenditure estimates for a fiscal year. The budget is proposed by the executive and approved by the legislature. An annual budget is prepared considering the revenue projections and expenditure needs. A budget deficit arises when expenditure exceeds revenue.

A budget surplus arises when revenue exceeds expenditure. Deficit financing refers to the borrowing by the government to meet the excess of expenditure over revenue. Public debt arises due to continuous budget deficits over the years.

Also Read: What Is Sponsor Finance and How Can It Benefit Your Business?

Sources of Public Revenue

The government raises revenue through various sources like:

- Taxes: The government imposes direct taxes like income tax and indirect taxes like sales tax, excise duty, etc. Taxes are the major source of revenue for the government.

- Fees and Charges: The government charges fees for the public services it provides like toll fees, license fees, etc. These user charges also generate revenue for the government.

- Borrowings: The government also borrows money from the public in the form of government bonds and securities. The interest and principal repayments on such borrowings are a source of revenue for the government.

- Grants and Aids: The government receives grants and aids from foreign governments and international institutions. These grants supplement the revenues of the government.

- Profits from Public Enterprises: The government also generates revenue from the profits and dividends of public sector undertakings.

Also Read: The Complete Guide to Mariner Finance Loans 2024.

Importance of Public Finance

Public finance is important for the effective functioning of the government. It enables the government to raise enough resources to finance public services and welfare schemes for citizens. Efficient management of public funds ensures macroeconomic stability and equitable distribution of resources in the economy.

Funds Essential Services

Public finance provides the funding for important government services like infrastructure, healthcare, education, national security, and social programs. Taxes from public finance pay for the roads and bridges we drive on, the schools our children attend, and the hospitals that provide us care.

Promotes Economic Stability

Government spending and taxation, the two main components of public finance, are also used to promote economic stability and growth. During economic downturns, governments can use spending and tax cuts to stimulate demand and pull countries out of recessions. They can also use taxation and spending to curb inflationary pressures when economies are overheating.

Also Read: Importance of Strategic Finance In Business Growth.

Redistributes Wealth

Public finance also aims to redistribute wealth through progressive taxation and social programs like welfare. The wealthy are taxed at higher rates, and these funds are used to support programs that benefit lower-income households. This makes society as a whole more equitable and just.

Funds Government Operations

Of course, public finance also funds the essential day-to-day operations of government like paying government employees, funding courts and justice systems, conducting foreign affairs, and ensuring national security. Without funding these basic functions, governments could not properly serve and protect their citizens.

Types of Public Finance

Public finance is a study of government’s revenue, expenditure and debt operations. There are two major types of public finance – public revenue and public expenditure.

Public revenue refers to the income generated by the government through taxes, fees, fines, and other sources. The government collects taxes from individuals and corporations to fund public services and infrastructure. The main sources of public revenue are income tax, sales tax, property tax, and corporate tax.

Public expenditure refers to the spending of government on public goods and services. The government spends money on education, healthcare, infrastructure, security, interest payments, welfare programs, and other public services. Public expenditure is classified into revenue expenditure and capital expenditure. Revenue expenditure is incurred on day to day expenses like salaries, interest payments, and subsidies. Capital expenditure is incurred on the creation of assets like roads, buildings, machinery, etc.

A good public finance system ensures that the government has enough revenue to fund important public services. At the same time, the tax rates should not be too high to discourage business activities. An optimal balance of public revenue and expenditure is essential for the overall economic growth of a country.

Also Read: The Ins and Outs of the Academy of Finance and Enterprise.

Difference Between Public Finance and Private Finance

When it comes to managing money, the difference between public and private finance comes down to who’s actually controlling the funds. Public finance refers to the management of money for government and public purposes, while private finance deals with money for individuals, families, and businesses.

As a taxpayer, public finance directly impacts you. The government collects taxes from citizens and businesses to fund public services like infrastructure, healthcare, education, and national security. How the government allocates these funds is a matter of public finance. On the other hand, private finance is how you manage your own personal money and make spending decisions.

Public finance aims to benefit society as a whole, while private finance focuses on you and your family’s financial well-being. Another key difference is transparency. Government budgets and spending are public records that citizens can access. On the other hand, your personal finances and money management strategies, typically remain private unless you choose to share that information. Public and private finance also follow different rules and policies.

Between this 2, there are many other differences. While public and private finance are quite distinct, they do impact each other. For more information about public and private finance differences, read from Shiksha.com.

Conclusion

You now have a solid understanding of public finance – what it is, why it’s important, and how it impacts society. The key takeaways are that public finance deals with government revenue and spending, can influence economic stability and growth. It is very important and we all should follow the government roles for our betterment.