Whether you’re an aspiring manager or current business leader, the basic knowledge for managerial finance is essential for you.

Managing a business greatly and effectively is the key to business growth. In this article, we’ll provide a straightforward overview of managerial finance and actionable strategies to implement its key concepts. You’ll learn the fundamentals of financial forecasting, analysis, and decision making – no advanced degree required. Let’s get started on demystifying this topic so you can apply it with confidence.

What Is Managerial Finance?

Managerial finance refers to the practices and concepts that managers use to make financial decisions in a business. It involves the management of a company’s financial resources to achieve its goals. As a manager, you need to understand some basic principles of finance to make smart choices fomanagerial r your business.

As a business manager, you need to understand concepts like the time value of money, risk and return, and opportunity cost to make prudent financial decisions. Mastering managerial finance will help ensure your business remains financially stable and continues operating successfully.

Also Read: What is Public Finance? Concept, Definition and Importance.

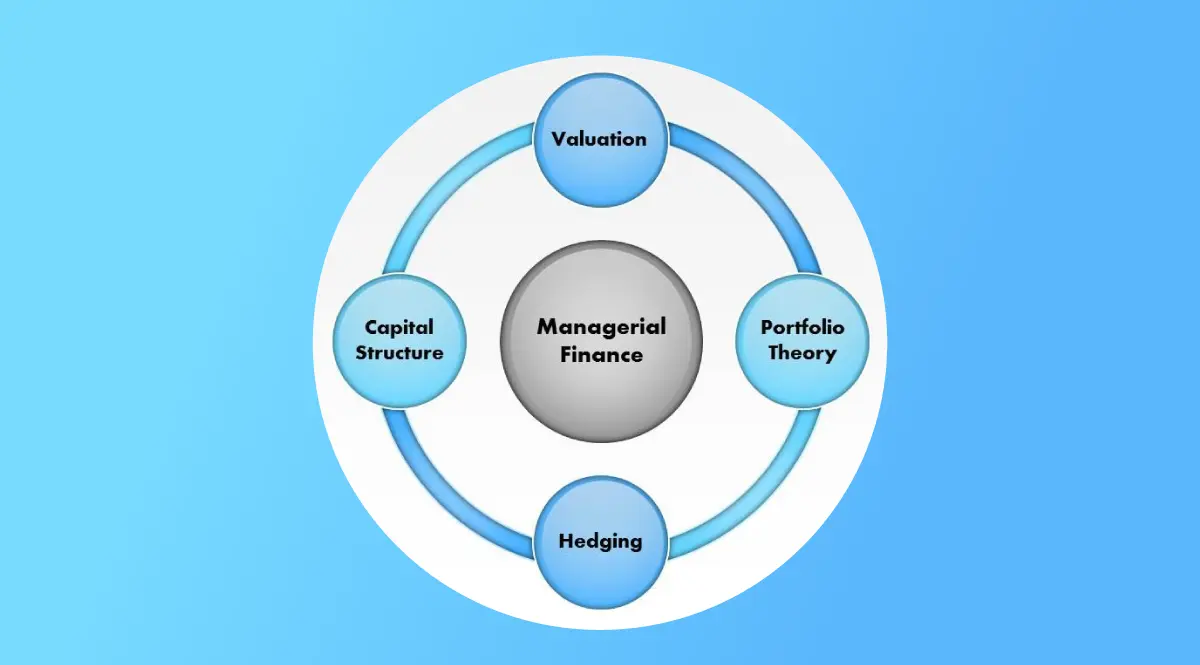

What are the Elements of Managerial Finance

As a manager, understanding the basic elements of managerial finance is crucial to making sound business decisions. The three primary areas you need to focus on are:

Cash flow

This refers to the amount of cash coming in and going out of your business. To manage cash flow effectively, you need to forecast how much money you expect to receive from sales and how much you need to pay for expenses. If more money is going out than coming in, you may face a cash crunch. The key is to ensure you have enough cash on hand to meet your financial obligations.

Capital budgeting

This involves evaluating potential investments to determine which projects are worth pursuing. Some common techniques used are payback period, net present value, and internal rate of return. The goal is to allocate your limited resources to the investments that will yield the highest returns.

Risk analysis

There is always an element of risk involved in business decisions, so you need to assess the level of risk and determine if it’s acceptable. Things like sensitivity analysis, scenario planning, and Monte Carlo simulation can help determine how changes in variables like sales volume, costs, and interest rates might affect your business. The lower the risk, the more stable and predictable your cash flow will be.

As a manager, paying close attention to these three areas will help ensure your business remains financially healthy and continues operating successfully. Keeping on top of trends in the market and industry, managing resources prudently, and making well-informed strategic decisions based on data are all part of the job. But with a solid understanding of managerial finance, you’ll be well equipped to handle whatever comes your way.

Also Read: The Fundamentals of Corporate Finance 2024.

What is International Journal Tips about Managerial Finance

The International Journal provides many valuable tips and tricks for all types of financing. The two most important International Journal tips for managerial finances are:

Managing Cash Flow

One of the most important aspects of managerial finance is managing your business’s cash flow. You need to make sure enough cash is coming in to cover expenses. If cash inflows are greater than outflows, that’s positive cash flow. If outflows exceed inflows, that’s negative cash flow and can be a sign your business is in financial trouble.

To maintain positive cash flow:

- Forecast cash inflows and outflows to detect potential shortfalls.

- Offer customers incentives to pay invoices promptly.

- Consider ways to reduce accounts payable by negotiating extended payment terms with suppliers.

- Look for expenses you can cut or reduce.

Securing Financing

Most businesses require outside financing at some point to fund operations, expansion, or large capital expenditures. As a manager, you need to evaluate funding options like loans, lines of credit, factoring, and equity financing to determine which is most suitable and affordable for your organization.

Securing adequate and appropriate financing is key to the long-term success of any business. However, debt also comes with risks that you must manage prudently to avoid issues like default or bankruptcy. Maintaining a strong balance between debt and equity in your capital structure is an important part of effective managerial finance.

Also Read: How to Take Control of Your Personal Finance 2024.

Key Responsibilities in Managerial Finance

As a manager, you must have a solid understanding of finance to make effective business decisions. Your key responsibilities include budgeting, financial planning, and cost management.

Budgeting is essential for determining how much money is available and allocating those funds efficiently. You’ll work with your team to estimate income and expenses for the upcoming year. Then figure out how to distribute resources to the areas that need them most. A well-thought-out budget gives you a roadmap for success.

Financial planning involves analyzing your company’s financial position and projecting how it may change over time. Develop strategies to maintain stability and support future growth. With good planning, you can take advantage of opportunities and avoid potential risks.

Another vital task is controlling costs. Compare actual spending to the budget regularly and make adjustments as needed to keep your company on track. Look for ways to cut unnecessary expenses without compromising quality or productivity.

Also Read: What Is Sponsor Finance and How Can It Benefit Your Business?

Why is Managerial Finance Important

Managerial finance is essential for any business. It helps managers make important decisions that impact the financial well-being of a company. As a manager, understanding finance concepts and applying them to your business allows you to evaluate opportunities, mitigate risks, and plan for a sustainable future.

How to Improve Your Skills in Managerial Finance

To become highly proficient in managerial finance, continuously improving your skills and knowledge is key. Here are some tips to help strengthen your finance abilities:

•Stay up-to-date with trends: The field of finance is constantly evolving. Make an effort to read industry publications, follow experts on social media, and stay on top of new software, tools, and techniques. Being well-informed will make you a more valuable employee and manager.

•Expand your technical skills: Learn how to use financial modeling, data analysis, and visualization tools. Take online courses on accounting, budgeting, forecasting, and reporting. The more you know, the more you’ll advance in your career.

•Improve soft skills: Strong communication, critical thinking, and problem-solving abilities are essential for anyone in a managerial role. Work on improving skills like active listening, relationship building, and persuasion. These soft skills, combined with your technical knowledge, will make you a well-rounded finance professional.

•Pursue continuing education: Consider earning certifications to strengthen your knowledge in areas like financial planning, risk management, or fraud examination. Some certifications may qualify you for higher pay or a promotion. You might also earn an advanced degree in finance, accounting, or business administration.

•Find a mentor: Having a mentor is one of the best ways to learn. Look for a senior finance manager or executive at your company and ask if they’d be willing to mentor you. Learn from their experience and use them as a sounding board for your ideas and decisions. Mentorship can help fast track your career progression.

Briefly, continuous self-improvement is what separates good finance managers from great ones. Make a habit of expanding your knowledge and abilities through ongoing learning and skill development. With time and practice, you’ll achieve a high level of expertise in managerial finance. Learn the complete overview of managerial finance from the Corporate Finance Institute.

Also Read: Importance of Strategic Finance In Business Growth.

Conclusion

You now have the basic overview and simple tips for understanding managerial finance. By learning the key principles, you can make informed financial decisions for your business or organization. Remember, finance is a skill that improves over time. Be patient with yourself as you build competency.